30+ Mortgage refinance rates today

Current 30-Year Mortgage Rates. As one of the Big Four American banks Chase has a major physical presence throughout the country with in-person mortgage experts available in 30 states across the continental US.

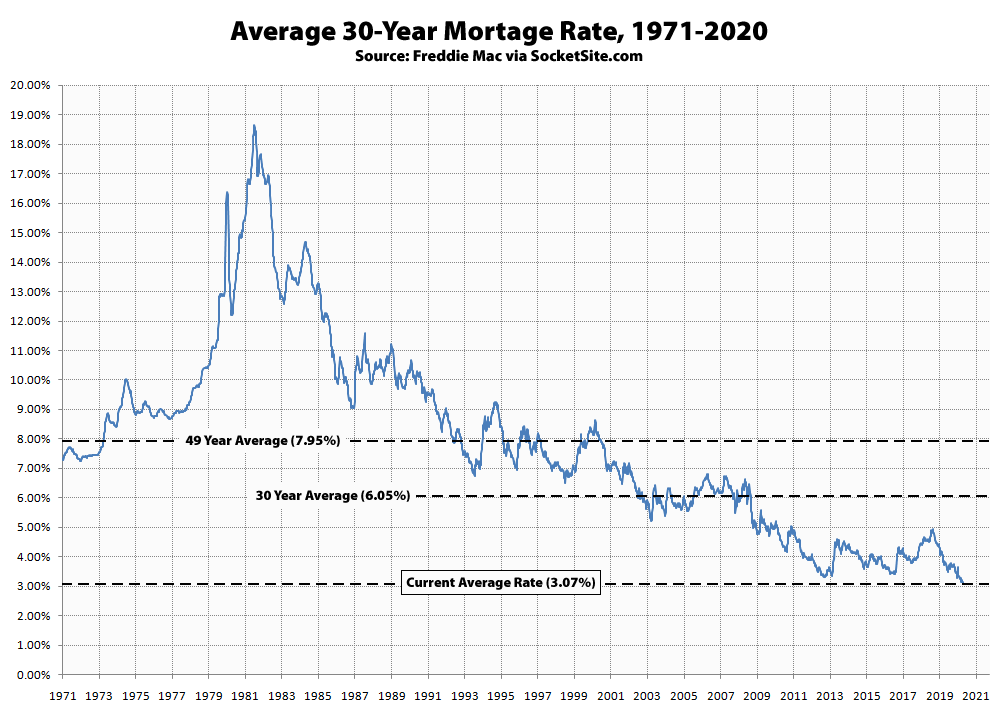

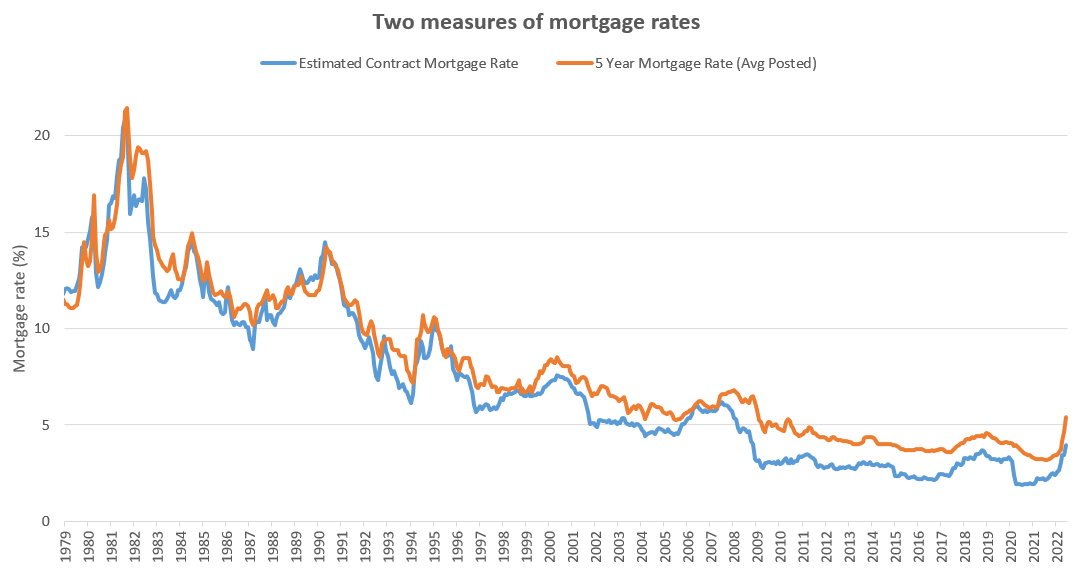

Benchmark Mortgage Rate Nearing An Unprecedented Mark

Mortgage refinance rates rose today except for 20-year rates which edged downStill with rates for longer terms over 55 homeowners looking to.

. 30 and 15 Year Fixed Rates. Freddie Mac reported today that the average offered interest rate for a conforming 30-year fixed-rate mortgage increased forty-two basis points 042 jumping. Meanwhile 20-year rates held steady and 10-year rates surged to hit 4750.

Current 30-year mortgage rates. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. The 52-week high for a 30-year fixed mortgage was 6.

Current Refinance Rates. On Wednesday August 31st 2022 the average APR on a 30-year fixed-rate mortgage fell 1 basis point to 5722The average APR on a 15-year fixed-rate mortgage remained at 4951 and the average. Check rates today to learn more about the latest 30-year refinance rates.

Mortgage refinance rates rose today except for 20-year rates which edged downStill with rates for longer terms over 55 homeowners looking to. For homeowners looking to refinance todays current average 30-year fixed refinance rate is 592 increasing 7 basis points since the same time last week. Meanwhile rates for 20-year terms rose.

Todays average rate on a 30-year fixed mortgage is 603 compared to the 592 average rate a week earlier. Rates for a 30-year refinance edged lower today bringing this popular term further below the 5 mark. 2 days agoHistorically adjustable mortgage rates tend to be lower than 30-year fixed rates.

Todays average 30-year fixed mortgage rate is 555 according to Freddie Mac the highest its been since late July. Todays average rate on a 30-year fixed-mortgage refinance is 603 compared to the 592 average rate a week earlier. Compare 30-year refinance rates and choose your preferred lender.

View todays current mortgage rates with our national average index calculated daily to bring you the most accurate data when purchasing or refinancing your home. What this means. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher.

When mortgage rates go up ARMs can start to look like the better deal. See todays mortgage rates and get the best refinance mortgage rates or purchase mortgage rates by comparing mortgage rates for 30 year fixed 15 year fixed 51 ARMs and more. Rates were continually elevated in June but todays rates havent reached.

It offers just about every type of mortgage that a prospective customer might be looking for. Current 30-Year Fixed-Mortgage Refinance Rates. These include fixed-rate adjustable-rate jumbo FHA and VA mortgages with the banks proprietary.

Refinance rates valid as of 31 Aug 2022 0919 am. Thirty and 20-year mortgage refinance rates fell over the weekend bringing rates for all repayment terms under 5 for the first time in 42 daysAdditionally rates for longer. Get Your Custom Rate.

When choosing a lender compare official Loan Estimates from at least three different lenders and specifically pay attention to which have the lowest rate and lowest APR. What this means. 2 days agoWhat this means.

If your original mortgage was a 30-year loan you could refinance to pay it off sooner. 2 days agoWhat this means. Rates for a 30-year mortgage refinance fell more than a quarter point today.

Use our calculator to see estimated rates today for mortgage and refinance loans based on your specific needs. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years. Along with mortgage interest rates each lender has fees and closing costs that factor into the overall cost of the home loan.

View daily mortgage and refinance interest rates for a variety of mortgage products and learn how we can help you reach your home financing goals. What this means.

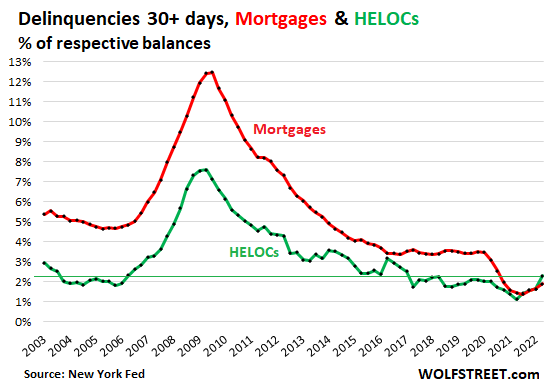

Trip Back To Reality Starts Q2 Mortgages Helocs Delinquencies And Foreclosures Seeking Alpha

A Refinance Opportunity Has Emerged Mortgage Rates Have Declined

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go

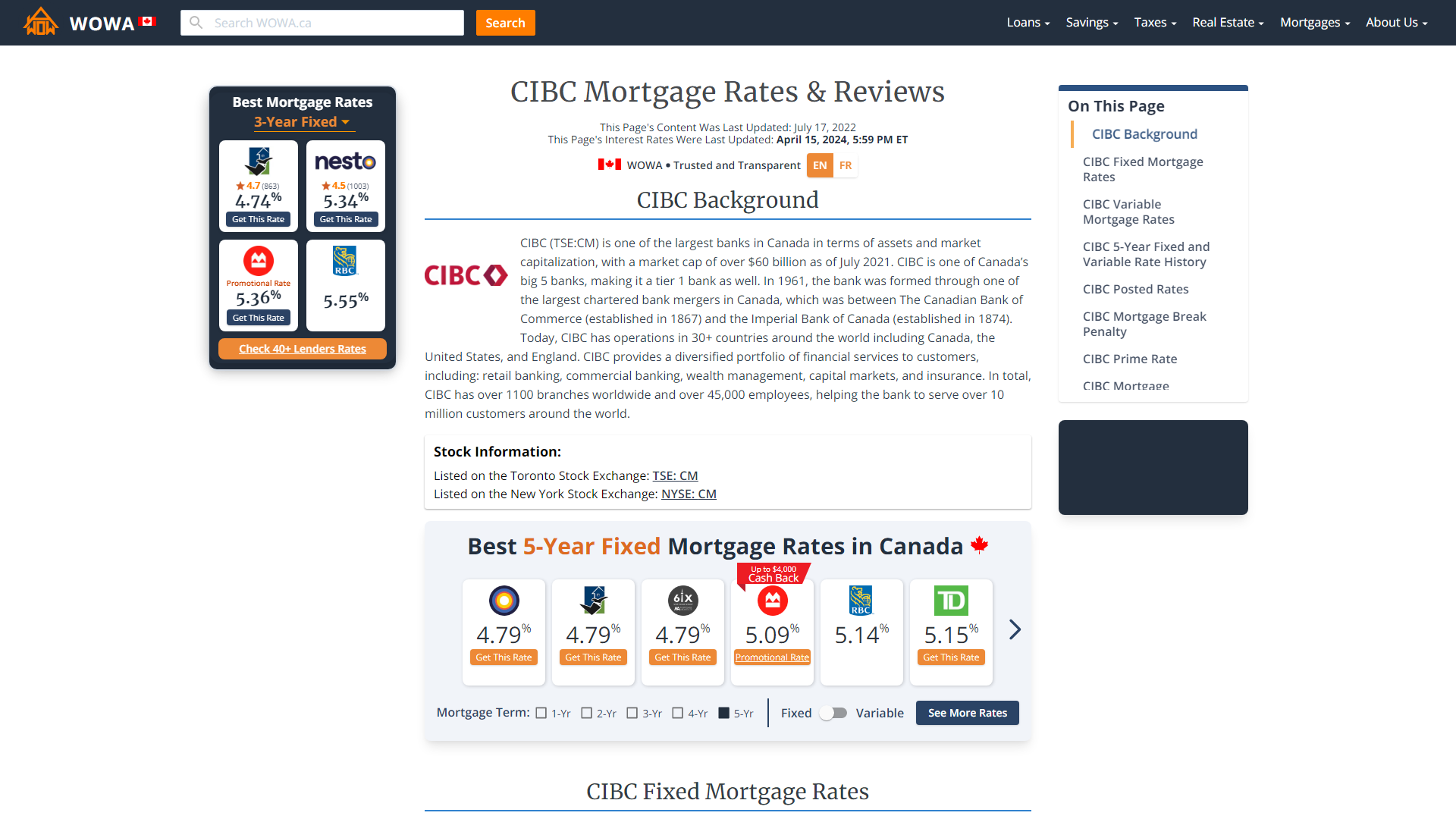

Cibc Fixed And Variable Mortgage Rates Aug 2022 From 4 39 Wowa Ca

Buyers Strike Mortgage Applications Drop 8 Below 2019 As Home Buyers Get Second Thoughts About Raging Mania Wolf Street

How Are Mortgage Rates Determined Mortgage Mortgage Rates Understanding Mortgages

Debt Payment Tracker Printable Debt Tracker Printable Debt Etsy Budget Planner Printable Money Planner Budget Planner

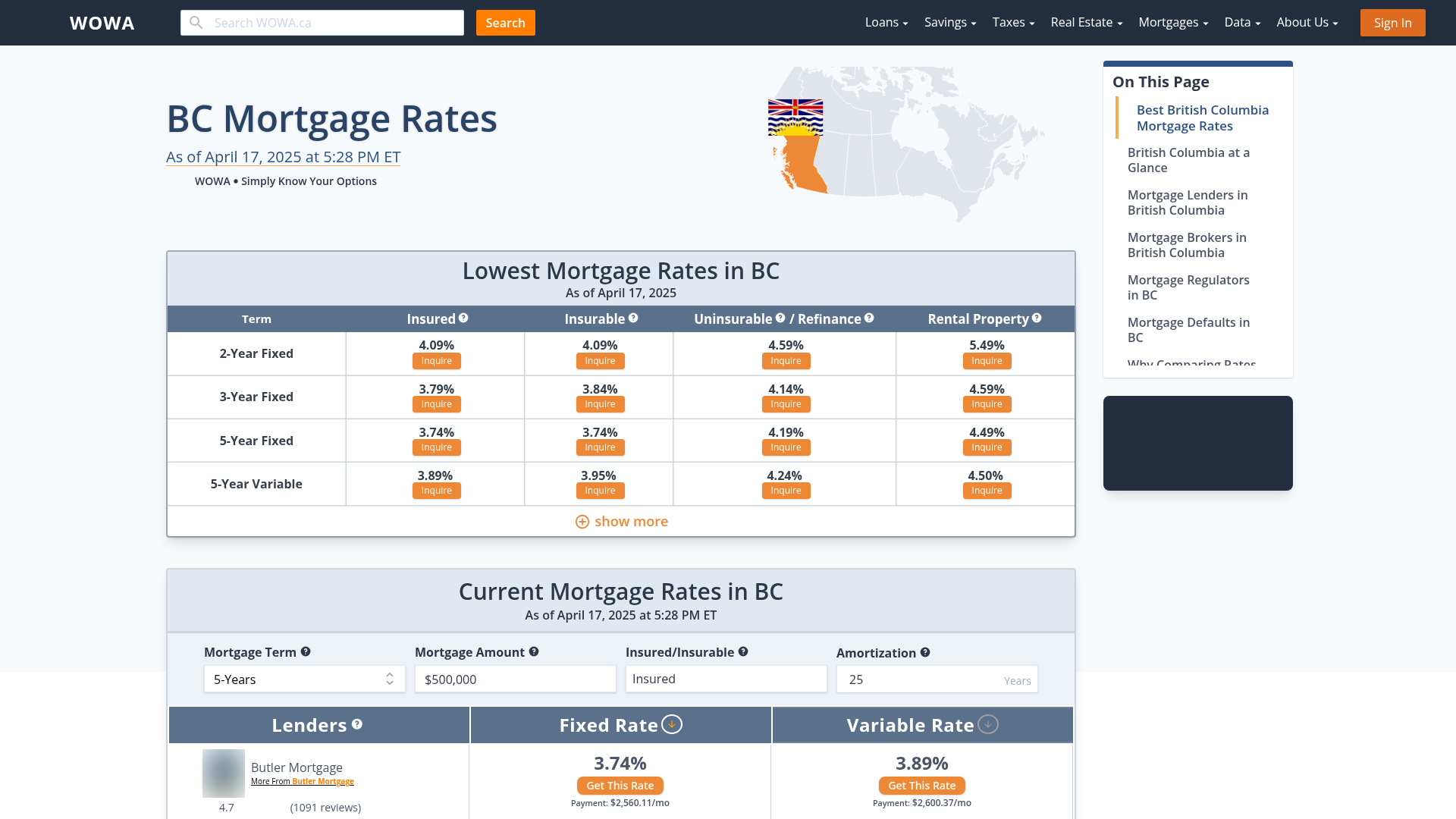

British Columbia Mortgage Rates From 30 Bc Lenders Wowa Ca

Hospitalist Physician Jobs In Oklahoma Browse 30 New Positions

How Federal Tapering Effects The Housing Market Economy Infographic Mortgage Interest Rates Mortgage Payoff

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

A Refinance Opportunity Has Emerged Mortgage Rates Have Declined

Mortgage Calculators Lowermybills Mortgage Refinance Mortgage Mortgage Help

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

High Frequency Un Affordability House Hunt Victoria

Was Getting An Arm Before Inflation And Rates Went Up A Bad Move

Refinancing Of Commercial Property Loan Mortgage Supermart Singapore Mortgage Supermart Singapore Wordpress Mortgage Loans Singapore Business Finance Loans