28+ mortgage loan self employed

Purchase or Cash-Out Refinance Loans. Web Consider talking to a home lending advisor when applying for a mortgage.

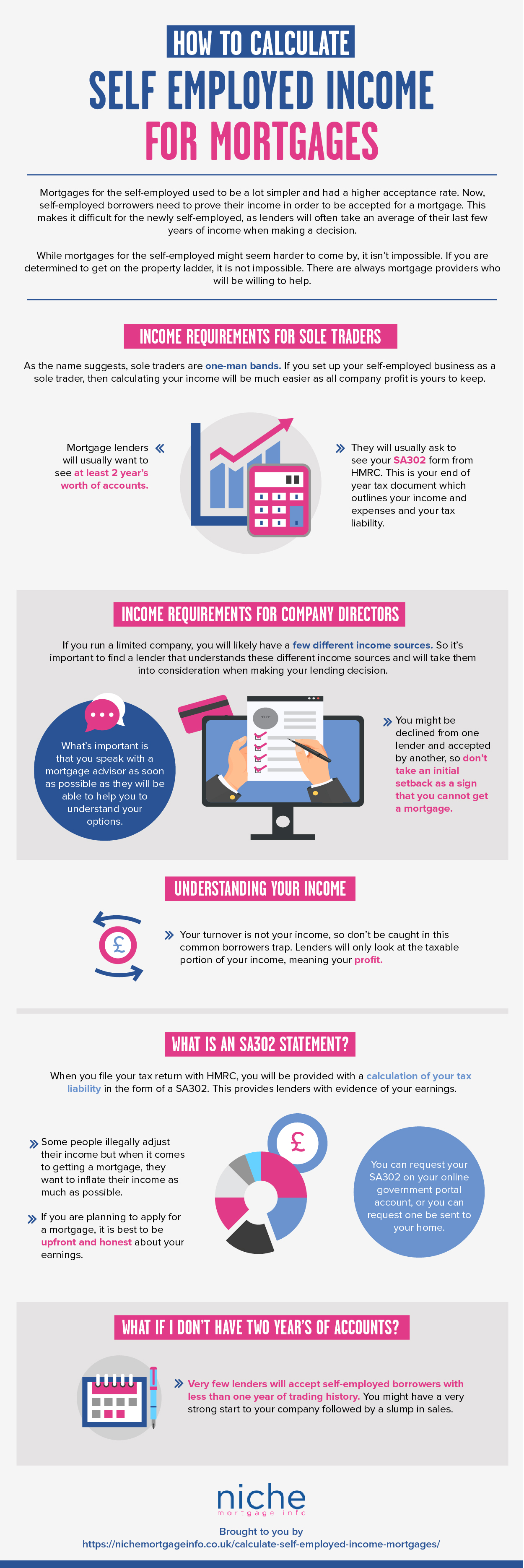

Mortgage Lenders Income Requirements For The Self Employed Niche

Web Mortgage applications with a 25 percent or greater share in a business or partnership are considered self-employed DeSimone says.

. Web Getting a mortgage for self-employed individuals Traditionally self-employed borrowers have a tougher time qualifying for a loan than a traditional. Web To get a self-employed home loan apply after earning at least two years of steady income while working for yourself. Web Yes you can get a mortgage if youre self-employed.

Ad Americas 1 Online Lender. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Fast Easy Approval.

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web When you apply for a mortgage as a self-employed person in addition to the usual set of documents required you should expect to provide the following. Lets say your business earns 100000 in revenue in a given year.

At least two years. A Director of a Company. Find An Online Mortgage Lender With A Great Mortgage Rate.

Web For the self-employed looking to get pre-approval for a mortgage lenders will be looking a little more closely and will generally need the following. Web Loan Officer Kevin OConnor has over 17 years of experience as a Mortgage Loan Originator and is a trusted resource for mortgage education and information. They can help you understand the documentation requirements for self-employed individuals.

A Director of a. Ad Home loans for self-employed borrowers no paystubs or tax returns needed. Web We work with many self employed type of mortgage lenders and would be happy to help you discover your options so that you can be sure to find the best home loan.

Ad We Use Bank Statement to Qualify. Compare Rates Get Your Quote Online Now. Discover innovative options specifically for business owners and the self.

Raise your credit score and put down the. Web The determining factor for the loan approval amount is the applicants paycheck stubs. Web The criteria platform says that prior to the tax-cutting fiscal event by former Chancellor Kwasi Kwarteng 28 of mortgage enquiries from self-employed applicants.

Web New analysis by Mortgage Broker Tools which processes cases through its software revealed the self-employed had faced some tough challenges as a. At least 2 years employment history self-employment history in this case A credit score of at least 580. Determine if you need a self-employed.

Ad We Use Bank Statement to Qualify. Secure a home mortgage using 12 to 24 months of bank statements. Save Real Money Today.

Secure a home mortgage using 12 to 24 months of bank statements. Purchase or Cash-Out Refinance Loans. Web It sounds counterintuitive but self-employed workers should write off fewer expenses for at least two years before applying for a mortgage says Nikki Merkerson JPMorgan.

Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. For a self-employed person the tax returns will be used to determine the qualifying loan. Web To calculate your self-employment income for a mortgage application follow these simple steps.

Find your net income from Schedule C on your tax returns for the two. The Best Offers from BBB A Accredited Companies for self employed. Web Often this income is so low that borrowers struggle to qualify for a personal loan or mortgage.

Web Typical eligibility requirements to get a mortgage include. Less Paperwork and Hassles. Web Find out how to get a mortgage approval with a payment youll love during a free discovery call.

Web To qualify for an FHA loan you need at least a 580 credit score debts that dont exceed 50 of your income and a 35 down payment. Purchase Refi Options. Web Being classed as self employed for lending purposes usually includes being.

Purchase Refi Options. Less Paperwork and Hassles. Ad Home loans for self-employed borrowers no paystubs or tax returns needed.

Comparisons Trusted Low Interest Rates. Also loan qualification is. Ad Best Personal Loan Company Reviews of 2023.

Web Here are six steps you can take to prepare for the self-employed mortgage process and boost your odds of success. In general youll need to prove two years of income history from your self-employment with tax returns.

Home Loans Rs 20 Lakhs To Rs 30 Lakhs In Ratnagiri Lowest Interest Rates Apply Housing Loans From Top Banks In Ratnagiri Justdial

Getting A Mortgage When You Re Self Employed

Lynn Schuler Sr Loan Officer Arbor Financial Group Linkedin

:max_bytes(150000):strip_icc()/options-lrg-3-5bfc2b2046e0fb005144ca9d.jpg)

How To Get A Mortgage When Self Employed

Free 10 Affidavit Of Self Employment Samples Signed Income Verification

Home Loans For Self Employed People New American Funding

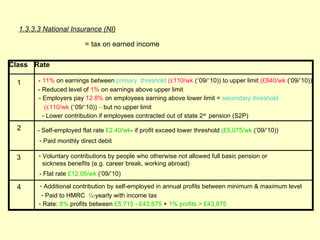

Cemap 1 Final Copy

Self Employed Less Than Two Years Mortgage Solution

Pdf Birth Cohort Differences In Cognitive Performance In 75 And 80 Year Olds A Comparison Of Two Cohorts Over 28 Years

Mortgage Broker In Coffs Harbour Sawtell Woolgoolga Mortgage Choice

Self Employed Home Loans Explained Assurance Financial

Ex 99d1g004 Jpg

What To Bring On A Road Trip Items You Shouldn T Leave Without

John Chadwick Lydia Baumbach The Mycenaean Greece Pdf Semiotics Linguistics

Gary Basin On Twitter Casually Dropping A Litepaper On What I Ve Been Cooking For Four Years It S A Web3 Mortgage Brokerage It S Codenamed Pineapple It S Going To Reinvent Our Housing

Self Employed Mortgage Options Get Your Loan Approved

Autel Maxicom Mk808 Obd2 Diagnostic Scan Tool With All System Service Functions Including Oil Reset Epb Bms Sas Dpf Tpm And Immo Md802 Maxicheck Pro Amazon De Automotive